One of the joys of writing a money blog like Get Rich Slowly is the continuing self-education. I’m always reading and learning about personal finance. A lot of the times — as in the past month — this education is about esoteric topics. I’m currently diving deep into the history of personal finance, a subject that’s interesting to me but admittedly not of much practical use in the modern world. (Today in the mail, I got a book about advertising and the use of credit during the 1920s. How’s that for esoteric?)

But sometimes, this self-education does have practical uses, and it’s stuff that I can share with you folks so that you too can become better educated.

For instance, I have a huge blind spot when it comes to so-called “robo-advisors”. When I stopped writing here in 2012, robo-advisors existed but they hadn’t yet become a Big Deal. By the time I re-purchased this site in 2017, things had changed. Robo-advisors had become a major force in the investment industry — and I was clueless about what they were.

I’ve remained (mostly) clueless for almost three years now. I have a general idea of what robo-advisors are and how they operate, but only in the broadest sense. During our weekly planning call on Monday, I mentioned this blind spot to my business partner, Tom.

“You should write about robo-advisors,” Tom said. “If you don’t know what they are, I’ll bet there are plenty of readers who don’t know either. Do some research, write it up, and then everybody benefits.”

Tom is a smart man.

Here then is my research into the world of robo-advisors. What are they? How do they work? And who should use them? Let’s find out.

What is a Robo-Advisor?

Simply put, a robo-advisor is a company (or service) that offers investment management with a minimum of human input. Traditional financial advisors are all about human interaction. Robo-advisors are not. Let’s look at an example.

Before 2020 descended into chaos, Kim and I were having bi-weekly meetings with Luna Jaffe, a local Portland financial advisor.

Once every two weeks, we’d drive to Luna’s office. For an hour, Luna would ask us about our plans. She’d then offer advice and suggestions about how we should handle our money. If we were actual clients — instead of colleagues and friends wanting to learn about how this process works — we might then allow Luna to manage our investment accounts. (And, in fact, Kim may still do this in the future.)

A traditional financial advisor helps her clients get clear on their goals, then offers advice about how the clients can best manage their money to achieve those goals. Plus, the advisor acts as a sort of voice of reasons as the market rises and falls.

A robo-advisor, on the other hand, does none of this. In fact, I’d argue that the “advisor” portion of the term “robo-advisor” is a complete misnomer. Robo-advisors offer no advice. None. Zip. Nada. Sure, they might have blogs on their websites, but they deliberately steer clear of giving specific recommendations to clients. Robo-advisors are not financial advisors.

And, in fact, if you visit the website of any robo-advisor, you’ll see they never ever use that term. Nor do they ever claim to be financial advisors. (And they specifically disclaim that they’re offering financial advice.)

Well then, what do robo-advisors actually do?

Because I’m a nerd, I always want to know how and why and when. Why do we call these companies robo-advisors? And when did the term first come into use?

The short answer: Nobody knows.

The long answer: According to Business Insider, the first use of the term “robo-advisor” actually was “robo-adviser” (with an “e” instead of an “o”) and occurred in the title of a 2002 journal article. But the term didn’t appear in the article itself.

After that, the term wasn’t used again until 2011 (when it appeared again in the same journal as the first use). Then, in 2012, the name exploded in use and popularity. And that explains why I don’t know anything about robo-advisors. They became a thing exactly at the time I “retired” from the world of personal finance.

For more info, check out this short article that offers a brief history of robo-advisors.

What Do Robo-Advisors Do?

Robo-advisors might be more accurately described as automated investment-management tools.

Let’s use Betterment as an example. Betterment was founded in 2008, and the company launched its investment service in 2010. Today, a decade later, Betterment also offers tools to help people manage spending and start saving.

Here’s how Betterment describes itself:

Betterment helps you manage your money through cash management, guided investing, and retirement planning. We are a fiduciary, which means we act in your best interest.

We’ll ask a bit about you when you sign up. We’ll also gather information when you sync your outside accounts. Then, we’ll help you set financial goals and set you up with investment portfolios for each goal.

For your long-term financial needs (like retirement, next year’s vacation, or a down payment), our investment strategy is built on low-cost ETFs (exchange-traded funds) and a risk profile based on how long you plan to invest.

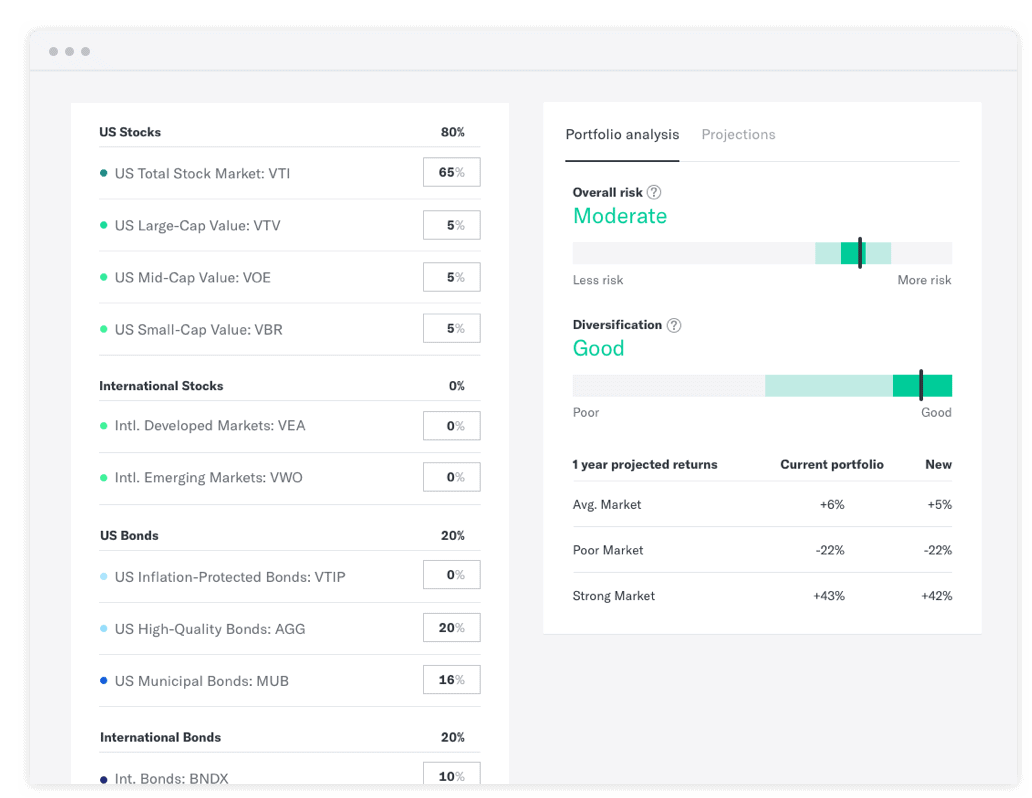

So, Betterment offers investment portfolios built on exchange-traded funds — index funds that you can trade like a stock. It appears that the company offers several pre-constructed portfolios, or allows individual investors to build their own from a small universe of ETFs. Here’s a screenshot that I pulled directly from the Betterment page on how their portfolios work.

I can’t tell exactly, but it seems like Betterment offers maybe four primary pre-built portfolios, plus allows customers to build their own. (Maybe an actual customer can chime in with a comment about how this works?)

Other robo-advisors offer similar services. Here, for instance, is a screencap from the Wealthsimple website that describes how its product works.

Most robo-advisors offer a variety of accounts. You can start a regular, taxable investment account. You can contribute to your IRA. And a few allow you to contribute to your 401(k). I think Vanguard Digital Advisor is set up for this. I know that Blooom was specifically created to be a 401(k) robo-advisor.

So, the bottom line is this: Robo-advisors are not advisors. They’re simply platforms that make it easier for people to get started investing. (Note that unlike some robo-advisors, Betterment does offer actual financial advice if you’re willing to pay an additional fee.)

Note: I often hear Robinhood mentioned as a robo-advisor. It’s not. Robinhood is a DIY investment platform, much the same as Sharebuilder was fifteen years ago, but it’s decidedly not a robo-advisor.

I think it’s important to note that traditional investment companies have begun to launch their own products to compete with the robo-advisor industry. In fact, currently the largest robo-advisor of all is from The Vanguard Group, the mutual-fund company so popular (and justifiably so) with the early retirement community. Charles Schwab has the second-largest robo-advisor.

The Pros and Cons of Robo-Advisors

The biggest advantage of robo-advisors is that they take care of portfolio maintenance for you. Once you’ve selected an investment strategy, the robo-advisor will take care of everything else.

Whenever you make a contribution, the robo-advisor allocates the funds according to your plan. When you sell, the robo-advisor sells according to your plan. And, perhaps best of all, the robo-advisor will monitor your asset allocation and make adjustments, if needed.

Rebalancing your investment portfolio — the process of shifting your money around so that you maintain your target asset allocation — can be tedious and complicated. (It’s so annoying, in fact, that I don’t do it at all. It helps that John Bogle, one of my investing heroes, believed that rebalancing is optional.)

Another advantage of robo-advisors is that they’re a “good enough” solution.

Too many people are paralyzed by indecision. They fail to invest because they don’t want to make a mistake. Or they want to make the best possible choice.

Well, robo-advisors aren’t the best possible choice, but they’re fine. They’re good enough. Investing with Betterment or M1 Finance or Wealthfront will give you smart, affordable options.

The biggest downside to robo-advisors that I can see is cost.

As you probably know, costs are the second-largest drag on investment performance for the average person. Study after study has shown that the best predictor of long-term investment growth are the total fees for any given investment vehicle. So, adding fees to your investing doesn’t make much sense.

That said, there are a couple of reasons you might not mind paying these fees.

- First, robo-advisor fees are typically much less than what you’d pay a traditional financial advisor. (That said, you pay more for a traditional advisor because she, well, actually provides advice.)

- Second, while fees are the second-largest drag on investment performance, the number-one barrier to performance is investor behavior. Generally speaking, you are your own worst enemy when it comes to making your money grow. And if paying a fee will help prevent you from sabotaging your future, then it’s probably worth the cost.

If you’re already set up and running and managing your own investments, keep doing what you’re doing. You don’t need a robo-advisor. And if you’re self-motivated and willing to spend some time on self-education, it’s perfectly possible to replicate the services a robo-advisor provides without using one. Nowadays, the major mutual fund companies allow you to buy and sell ETFs (or, better yet, index funds) via an easy-to-understand web interface. That’s what I do at Fidelity!

But not everyone learns to ride a bike without assistance. Some kids need training wheels, and there’s absolutely nothing wrong with that. In my mind, robo-advisors are like training wheels for people learning to invest. They serve a purpose.

That sounds a bit condescending, I know, but I don’t mean it to be. On our call Monday morning, Tom admitted that even he might make the move.

“I’m almost considering a robo-advisor,” he said. “I’m ready to outsource this stuff. I just don’t want to think about it anymore. I don’t want to rebalance. I don’t want to watch the market.”

He paused for a moment, then added: “I do still have a problem with the fees, though.”

A Final Word of Warning

When reading online reviews of robo-advisors, take them with a grain of salt. This is a growing industry that’s advertising heavily. People are paid to promote these companies. (And, in fact, when I link to certain platforms from this article, I’m using affiliate links too.)

When reading online reviews of robo-advisors, take them with a grain of salt. This is a growing industry that’s advertising heavily. People are paid to promote these companies. (And, in fact, when I link to certain platforms from this article, I’m using affiliate links too.)

So, if you go to a popular site and see that every robo-advisor earns 4.5 stars, that should make you skeptical. It makes me skeptical, anyhow. And note that nobody talks about Vanguard Digital Advisor, the largest robo-advisor out there. Why not? Because Vanguard doesn’t pay commissions for sending people their way. Ah, that thin green line makes it so difficult to trust financial websites sometimes!

After I wrote this article, Tom and I chatted. We’ve agreed that as we bring on staff writers here at Get Rich Slowly, it’d probably be a good idea to have them review various robo-advisors. We get a lot of questions about them in the Facebook group, but I personally don’t want to take the time to investigate all of them. I just don’t care. (Plus, I think most readers are best served by managing their money themselves.)

As we do this, though, I don’t want to take the same approach as everybody else. Sure, the our reviews will probably be cursory, the same as everyone else. They’ll provide the basics of each product and not much more. But we won’t patronize you by rating every service 4.5 stars. (I doubt that we’ll provide ratings at all!) And if we ever do a round-up of “best robo-advisors”, we’re not going to simply recommend those that pay us. That’s a bunch of bullshit.

Bonus! Although I didn’t know much about robo-advisors before researching this article, I am a huge huge fan of the Wealthsimple magazine. It’s outstanding. The magazine’s money diaries are great. So are the how-to pieces and the customer questions. And relevant for me and Tom is this recent piece on the in-game economy for Nintendo’s Animal Crossing: New Horizons. (Both Tom and I are playing the game at the moment. Our Monday calls often start with a discussion of turnip prices.)

Recent Comments